What Is An Actuary Job? This question unveils a fascinating world of risk management and financial forecasting. Actuaries are highly skilled professionals who use mathematical and statistical methods to assess and manage risk, primarily within the insurance and finance sectors. Their work involves analyzing data, building complex models, and providing insights to help organizations make informed decisions about financial security.

The actuarial profession boasts a rich history, evolving from its origins in calculating life insurance premiums to encompassing a wide array of specialized fields.

From predicting the likelihood of natural disasters to evaluating the financial soundness of pension plans, actuaries play a critical role in ensuring financial stability across numerous industries. This in-depth exploration delves into the education, skills, responsibilities, and career paths of these vital professionals, shedding light on a rewarding and intellectually stimulating career.

What is an Actuary?

Actuaries are financial professionals who use mathematical and statistical methods to assess and manage risk. They analyze data to predict future events and develop strategies to mitigate potential financial losses. Their work is crucial in various industries, particularly insurance and finance, where understanding and managing risk is paramount.

The Role of an Actuary

Actuaries evaluate the probability of future events, such as accidents, illnesses, or natural disasters, and quantify the financial impact of these events. They use complex models to predict future outcomes and help organizations make informed decisions related to risk. Core responsibilities include designing insurance products, setting premiums, reserving funds for future claims, and conducting financial analyses.

Core Responsibilities of an Actuary

Actuaries are responsible for a wide range of tasks, including developing and implementing pricing models for insurance products, assessing the financial soundness of pension plans, analyzing investment portfolios, and managing risk within an organization. They also play a vital role in regulatory compliance, ensuring that companies meet all relevant legal and financial requirements.

A Brief History of the Actuarial Profession

The actuarial profession has its roots in the early days of insurance, dating back to the 17th century. Early actuaries focused on calculating life expectancies and setting appropriate life insurance premiums. Over time, the profession has evolved to encompass a much broader range of responsibilities, reflecting the increasing complexity of financial markets and risk management.

Examples of Actuarial Specializations

Actuaries specialize in various areas, including life insurance, health insurance, property and casualty insurance, pensions, and investments. Each specialization requires a unique set of skills and knowledge, and actuaries often focus on a particular area throughout their careers. For instance, a life insurance actuary might focus on mortality modeling, while a health insurance actuary might specialize in healthcare cost projections.

Comparison of Actuarial Career Paths

| Career Path | Industry | Typical Responsibilities | Required Skills |

|---|---|---|---|

| Life Insurance Actuary | Insurance | Mortality modeling, product development, reserving | Strong statistical modeling skills, knowledge of life insurance products |

| Health Insurance Actuary | Insurance | Healthcare cost projection, pricing, risk management | Knowledge of healthcare systems, statistical modeling, data analysis |

| Property & Casualty Actuary | Insurance | Catastrophe modeling, pricing, reserving | Strong analytical skills, knowledge of property and casualty insurance |

| Pension Actuary | Finance | Pension plan valuation, funding, risk management | Knowledge of pension regulations, financial modeling |

Education and Qualifications

Becoming a qualified actuary requires significant education and professional examinations. Aspiring actuaries typically pursue a university degree in a relevant field, followed by a series of rigorous professional exams. Continuing professional development is also essential for maintaining competency and staying abreast of industry changes.

Educational Requirements, What Is An Actuary Job

A bachelor’s degree in mathematics, statistics, actuarial science, economics, or a related field is typically required to enter the actuarial profession. A strong foundation in mathematics, statistics, and probability is crucial for success in this field.

Professional Examinations

Actuaries must pass a series of rigorous professional exams administered by organizations such as the Society of Actuaries (SOA) or the Casualty Actuarial Society (CAS). These exams cover a wide range of topics, including probability, statistics, financial mathematics, and risk management. The number and difficulty of exams vary depending on the chosen actuarial specialization.

Continuing Professional Development

Continuing professional development (CPD) is essential for actuaries to maintain their professional competency and stay current with the latest industry developments and regulations. This typically involves attending conferences, completing continuing education courses, and engaging in professional networking.

Key Skills and Attributes

Successful actuaries possess a strong combination of technical and soft skills. These include advanced mathematical and statistical skills, analytical and problem-solving abilities, programming skills (e.g., R, Python), excellent communication and presentation skills, and strong attention to detail.

Relevant University Degrees

Several university degrees provide a strong foundation for an actuarial career. These include Bachelor of Science (BSc) degrees in Actuarial Science, Mathematics, Statistics, Economics, Finance, and related fields. A strong quantitative background is essential.

Day-to-Day Tasks and Responsibilities: What Is An Actuary Job

A typical workday for an actuary can vary depending on their role and industry, but often involves analyzing data, building models, and communicating findings to stakeholders. They utilize statistical modeling to predict future outcomes and inform decision-making.

A Typical Workday in the Insurance Industry

An actuary in the insurance industry might spend their day analyzing claims data, developing pricing models for new insurance products, or assessing the financial soundness of the company’s reserves. This often involves working with large datasets and using specialized software.

Statistical Modeling in Actuarial Work

Actuaries use statistical modeling extensively to predict future events and quantify risks. They might use techniques like regression analysis, time series analysis, or simulation to model various scenarios and assess potential outcomes.

Actuarial Software and Tools

Actuaries utilize a variety of software and tools to perform their work. These include statistical software packages like R and Python, spreadsheet programs like Excel, and specialized actuarial software designed for tasks such as reserving and pricing.

Role in Risk Management and Assessment

Actuaries play a critical role in risk management and assessment by identifying, quantifying, and mitigating potential risks. They use their expertise to develop strategies for managing risks and ensuring the financial stability of organizations.

Actuaries assess and manage financial risks, using complex mathematical models to predict future outcomes. The precision required in this field is often compared to the meticulous planning involved in organizing events like a large-scale memorial service, such as the reported twomad funeral. Returning to the actuarial profession, this careful calculation extends to insurance, investments, and pensions, ensuring financial stability for individuals and organizations.

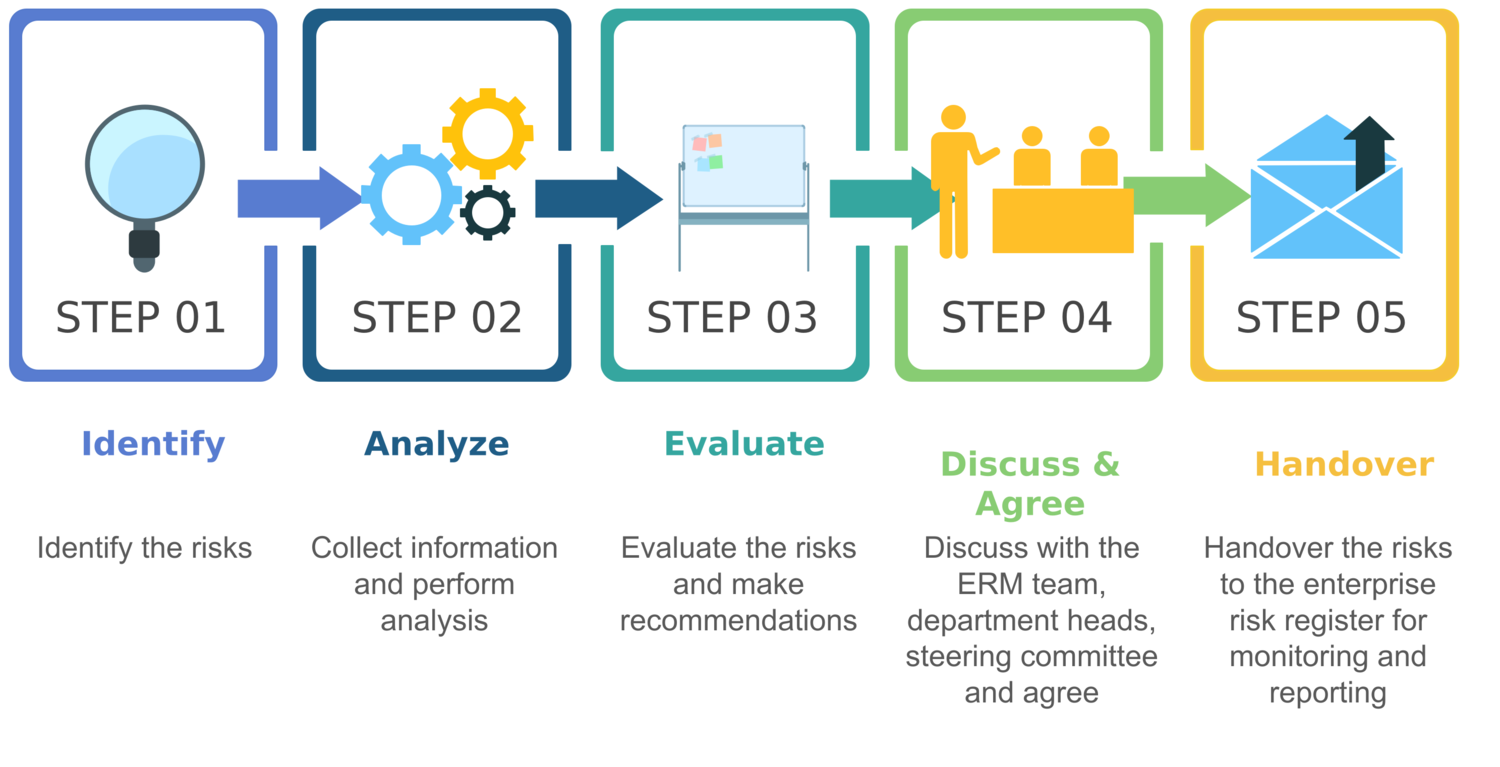

Flowchart of a Typical Actuarial Project

A typical actuarial project would begin with a clear definition of the problem and objectives, followed by data collection and cleaning. Next, an appropriate statistical model is developed and rigorously validated. Finally, the results and recommendations are communicated clearly to stakeholders.

Actuarial Fields and Industries

Actuaries are employed across various industries, with insurance being the most prominent. However, their expertise in risk management and financial modeling is valuable in many other sectors.

Industries Employing Actuaries

Beyond insurance, actuaries find employment in finance, consulting, government, and healthcare. Their skills are highly sought after in areas requiring sophisticated risk assessment and financial modeling.

Examples of Actuarial Roles

Source: squarespace.com

In insurance, actuaries might work as pricing actuaries, reserving actuaries, or financial reporting actuaries. In finance, they might be involved in investment management, risk management, or regulatory compliance. Consulting firms often employ actuaries to provide expert advice to clients across various industries.

Work Environment Comparison

The work environment can vary significantly depending on the industry and specific role. Insurance companies tend to have large, established actuarial teams, while consulting firms often offer more dynamic and project-based work. Government roles often focus on regulatory compliance and policy analysis.

Career Progression

Career progression for actuaries typically involves increasing responsibility and seniority within their chosen field. This often involves taking on more complex projects, mentoring junior actuaries, and taking on leadership roles.

Potential Career Advancements

- Senior Actuary

- Actuarial Manager

- Director of Actuarial Services

- Chief Actuary

- Consulting Actuary

Salary and Job Outlook

Actuarial salaries are generally competitive, reflecting the high demand for skilled professionals in this field. Salary levels vary based on factors such as experience, location, and specialization.

Average Actuary Salaries

:max_bytes(150000):strip_icc()/methods-handling-risk-quick-guide.asp_final-c386ed66ca654c3f8d6d14db0818183b.jpg)

Source: investopedia.com

Salaries for actuaries typically increase with experience. Entry-level positions might offer a lower salary, while experienced actuaries in senior roles can command significantly higher compensation. Geographic location also plays a role, with higher salaries often found in major financial centers.

Factors Influencing Actuarial Salaries

Location, specialization (e.g., life insurance vs. health insurance), years of experience, and the specific employer all influence actuarial salaries. Highly specialized actuaries or those with advanced degrees often earn more.

Projected Job Growth

The job outlook for actuaries is generally positive, with projected growth expected in the coming years. The increasing complexity of financial markets and the growing need for sophisticated risk management will continue to drive demand for actuaries.

Benefits and Perks

Many actuarial positions offer competitive benefits packages, including health insurance, retirement plans, paid time off, and professional development opportunities. Some employers also offer bonuses or profit-sharing based on performance.

Impact of Economic Conditions

Economic downturns can impact actuarial job opportunities, potentially leading to slower growth or even job losses in some sectors. However, the long-term outlook for the profession remains generally positive due to the enduring need for risk management expertise.

Essential Skills for Actuaries

A successful actuarial career demands a strong foundation in mathematical and statistical skills, along with crucial analytical, problem-solving, and communication abilities.

Mathematical and Statistical Skills

Actuaries must possess a deep understanding of mathematics and statistics, including probability theory, statistical modeling, and financial mathematics. These skills are essential for developing and applying actuarial models.

Analytical and Problem-Solving Skills

Actuaries routinely analyze complex data sets and solve intricate problems related to risk assessment and financial modeling. Strong analytical and problem-solving skills are essential for identifying and addressing challenges.

Programming Skills

Programming skills, particularly in languages like R and Python, are increasingly important for actuaries. These skills enable them to efficiently analyze large datasets and develop sophisticated models.

Communication and Presentation Skills

Actuaries must effectively communicate their findings and recommendations to both technical and non-technical audiences. Strong communication and presentation skills are essential for influencing decision-making.

Essential Hard and Soft Skills

| Hard Skills | Soft Skills |

|---|---|

| Statistical modeling | Communication |

| Programming (R, Python) | Problem-solving |

| Financial modeling | Teamwork |

| Data analysis | Time management |

End of Discussion

In conclusion, a career as an actuary offers a unique blend of intellectual challenge, financial stability, and societal impact. The path to becoming a successful actuary requires dedication to rigorous education and continuous professional development, but the rewards are substantial. With a strong foundation in mathematics and statistics, combined with exceptional analytical and communication skills, actuaries are uniquely positioned to navigate the complexities of risk and contribute significantly to the financial health of organizations and society as a whole.

The field’s promising job outlook and competitive salaries further cement its appeal to ambitious and mathematically inclined individuals.